All Categories

Featured

Table of Contents

This offers the policy owner returns choices. Returns options in the context of life insurance coverage describe just how policyholders can choose to use the rewards generated by their whole life insurance policies. Rewards are not assured, nonetheless, Canada Life Which is the earliest life insurance company in Canada, has actually not missed out on a dividend repayment because they first established a whole life policy in the 1830's before Canada was also a country! Below are the common returns options offered:: With this choice, the insurance policy holder makes use of the dividends to buy additional paid-up life insurance policy coverage.

This is only recommended in the situation where the survivor benefit is extremely crucial to the plan proprietor. The added price of insurance coverage for the boosted insurance coverage will certainly minimize the money value, therefore not ideal under limitless banking where money value dictates just how much one can borrow. It's crucial to keep in mind that the accessibility of dividend choices may vary depending on the insurance provider and the details plan.

Although there are terrific benefits for boundless financial, there are some things that you ought to consider prior to getting involved in boundless banking. There are likewise some disadvantages to infinite financial and it may not be ideal for somebody that is seeking budget-friendly term life insurance coverage, or if somebody is exploring purchasing life insurance coverage only to secure their family members in case of their death.

It is essential to understand both the benefits and constraints of this monetary method before choosing if it's best for you. Complexity: Limitless financial can be complex, and it is essential to comprehend the information of how an entire life insurance policy jobs and exactly how policy financings are structured. It is essential to correctly set-up the life insurance coverage policy to enhance unlimited banking to its complete potential.

What are the benefits of using Infinite Banking Concept for personal financing?

This can be specifically troublesome for people that rely upon the survivor benefit to offer for their liked ones (Policy loans). Generally, boundless banking can be a helpful monetary approach for those who recognize the details of exactly how it works and agree to accept the prices and restrictions linked with this investment

The majority of business have 2 different types of Whole Life plans. Over the course of several years, you contribute a considerable amount of cash to the policy to build up the money worth.

You're essentially providing money to yourself, and you pay back the loan with time, typically with rate of interest. As you repay the financing, the money value of the policy is replenished, allowing you to borrow against it once more in the future. Upon death, the survivor benefit is minimized by any type of outstanding car loans, but any kind of continuing to be survivor benefit is paid out tax-free to the beneficiaries.

Infinite Banking Benefits

Time Horizon Risk: If the insurance policy holder decides to cancel the policy early, the cash abandonment worths may be substantially less than later years of the policy. It is advisable that when discovering this strategy that has a mid to lengthy term time perspective. Tax: The insurance policy holder may incur tax obligation consequences on the finances, rewards, and death benefit payments obtained from the policy.

Complexity: Boundless financial can be complicated, and it is very important to recognize the details of the policy and the money buildup component before making any type of financial investment decisions. Infinite Banking in Canada is a legit financial strategy, not a scam. Infinite Banking is a principle that was created by Nelson Nash in the United States, and it has actually given that been adjusted and carried out by monetary specialists in Canada and other nations.

Plan loans or withdrawals that do not surpass the modified price basis of the plan are thought about to be tax-free. If plan finances or withdrawals surpass the modified price basis, the excess quantity might be subject to taxes. It is important to keep in mind that the tax obligation advantages of Infinite Financial may go through alter based upon modifications to tax regulations and laws in Canada.

The threats of Infinite Banking include the possibility for plan fundings to decrease the survivor benefit of the plan and the opportunity that the policy may not carry out as expected. Infinite Financial might not be the very best approach for every person. It is crucial to thoroughly consider the prices and possible returns of taking part in an Infinite Financial program, as well as to completely research and understand the affiliated dangers.

How does Infinite Banking Wealth Strategy compare to traditional investment strategies?

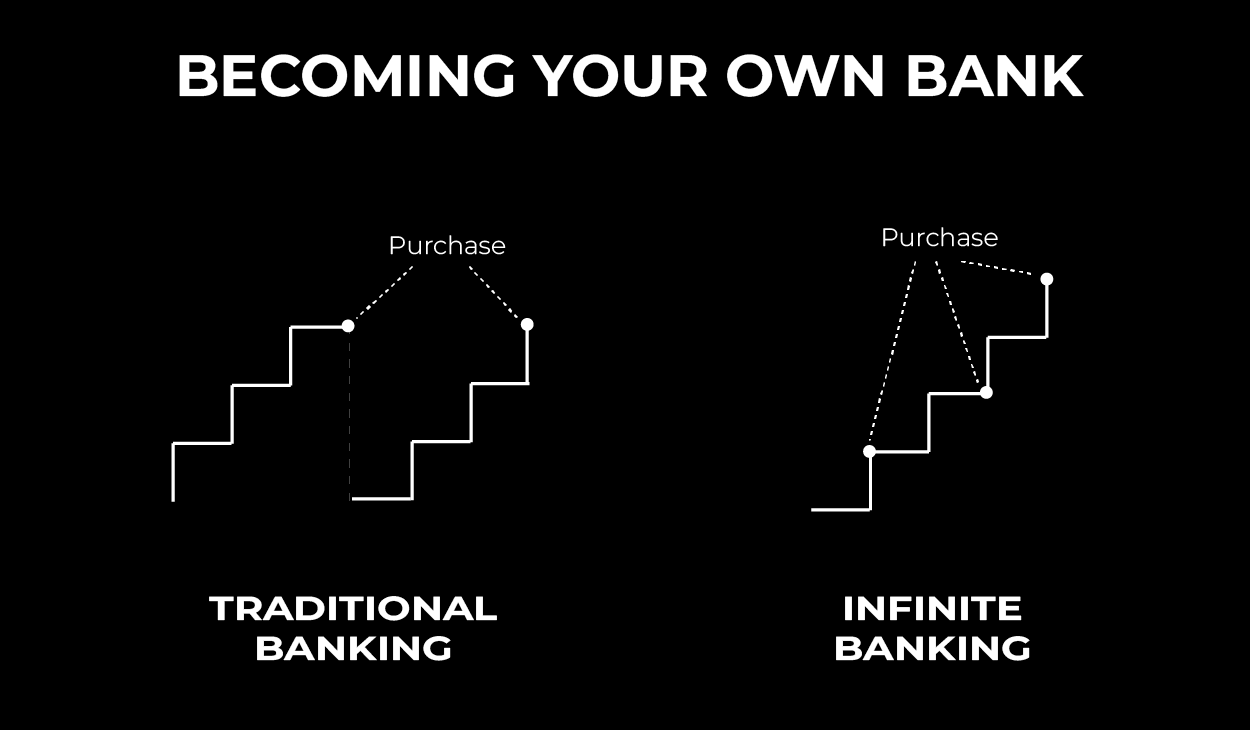

Infinite Financial is different from traditional banking because it permits the insurance holder to be their own resource of financing, as opposed to counting on traditional financial institutions or lenders. The insurance policy holder can access the cash value of the policy and utilize it to finance purchases or financial investments, without having to go with a conventional loan provider.

When lots of people require a lending, they use for a credit line with a traditional bank and pay that loan back, in time, with interest. But what if you could take a car loan from yourself? What if you could stay clear of the large banks completely, be your own financial institution, and supply on your own with your own credit line? For physicians and other high-income income earners, this is possible to do with limitless financial.

Here's an economic advisor's review of unlimited financial and all the pros and disadvantages included. Boundless banking is an individual financial approach created by R. Nelson Nash. In his book Becoming Your Own Banker, Nash explains just how you can use a permanent life insurance policy policy that constructs money value and pays dividends therefore releasing yourself from having to borrow money from lenders and repay high-interest finances.

What type of insurance policies work best with Infinite Banking Benefits?

And while not everyone gets on board with the idea, it has tested numerous countless people to rethink how they financial institution and exactly how they take fundings. Between 2000 and 2008, Nash released 6 editions of the book. To this particular day, financial advisors contemplate, method, and discuss the principle of unlimited financial.

The basis of the unlimited banking concept starts with long-term life insurance coverage. Boundless financial is not possible with a term life insurance policy; you need to have a permanent cash worth life insurance plan.

With a dividend-paying life insurance policy, you can expand your cash worth even quicker. Something that makes entire life insurance policy one-of-a-kind is gaining even more money with returns. Intend you have an irreversible life insurance coverage plan with a mutual insurance company. Because situation, you will be qualified to get part of the company's earnings much like how investors in the firm receive dividends.

Latest Posts

How To Be My Own Bank

The Infinite Banking System

How To Become Your Own Bank With Life Insurance